Green Bridge Metals Enters LOI to Option Large Bulk Tonnage Copper-Nickel-PGE Serpentine Project, Duluth Complex, Minnesota, USA

Breaking News:

Veranstaltungsankündigung: Online-Infotermin zum Digitalen dualen Studium

Wenn selbst Profis stolpern: Ein AHA rund um saba Wäsche – und Pflege wird spürbar leichter

„Keyless Start“, Vorkonditionierung und frische Farbe: Opel Frontera jetzt noch vielfältiger

Die Bad Griesbacher Kur- und Gästekarte wird noch attraktiver

Dienstag, März 3, 2026

Under the LOI, the parties will negotiate with a view to entering into a definitive agreement upon which Green Bridge would have the option to acquire up to a 70% interest in the Project on the following basis:

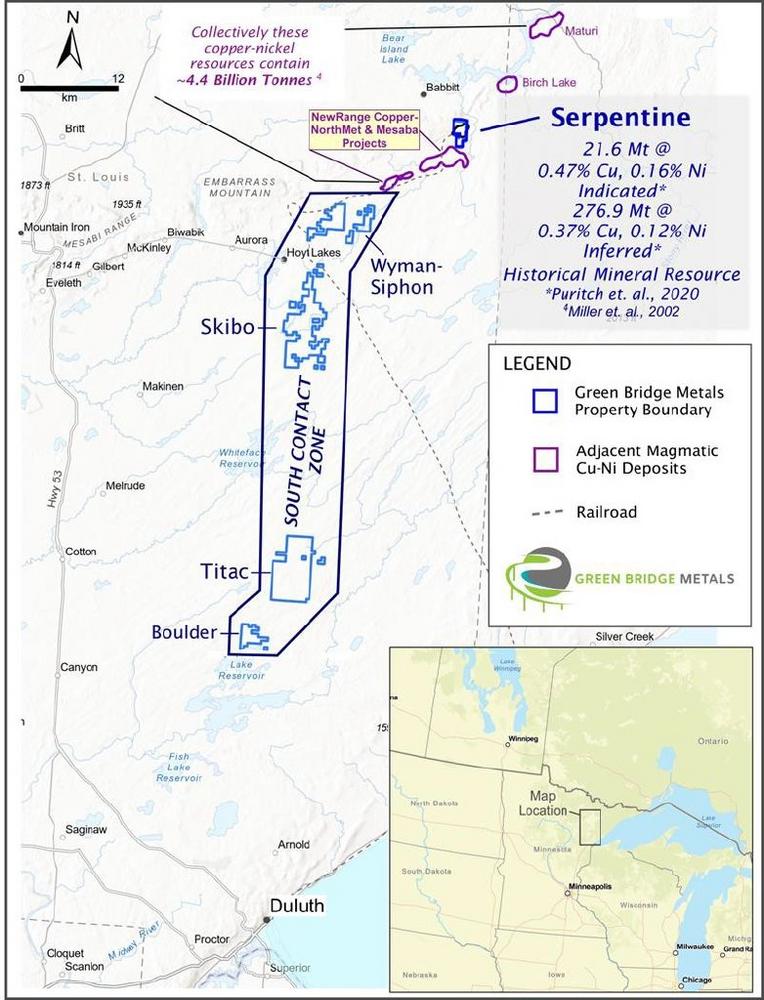

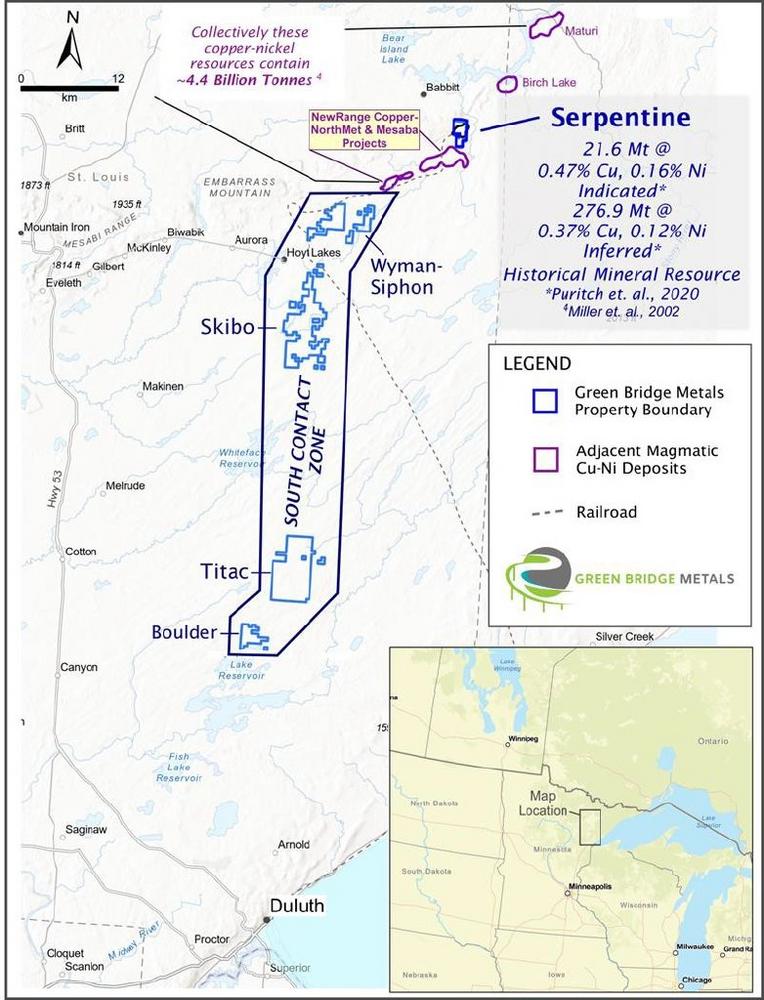

The Serpentine Project is located in the Mesabi Range mining district, along trend with several well-known significant deposits such as Maturi (1.8 Billion tonnes) (Barber et. al, 2014) and Mesaba (2.2 Billion tonnes) (Welhener and Crowie 2022) (Figure 1) and has access to roads, railways, and power immediately adjacent to the Project. The Company believes that an option in respect of the Serpentine Project would be a cornerstone for rapid value creation and will complement the existing high-potential exploration portfolio along the South Contact Zone.

* The estimates by Puritch et al. (2020) in this new release were completed to current CIM standards and use current classifications; however, they were completed on behalf of another issuer and have not been reviewed in the context of current metal prices and mining/processing costs and therefore are all considered historical in nature. A QP has not done sufficient work to evaluate these resources as current resources.

David Suda, CEO, stated: “Green Bridge is aggressively pursuing copper-nickel and other critical metals as set forth in our strategic plan since 2022. The potential for an option on the Serpentine Copper-Nickel asset in Minnesota, USA is a rare opportunity highlighting the company’s technical and strategic acumen. Green Bridge’s partnership with EMI and the Gilliam family, is rapidly growing from the existing exploration potential of the South Contact Zone to now potentially include the Serpentine Project. The geopolitical backdrop ensuing from recent announcements by The US Government is a major tailwind for American mining. Adding Serpentine to the Green Bridge portfolio will, we believe, put shareholders in a unique position of strength and leverage to rising commodity prices.”

Highlights of the Serpentine Deposit are:

Suda further stated: “The Serpentine land position is strategically located in a region of rare geological endowment and vast infrastructure including power, roads, rail and seaports. Located adjacent to the NewRange Copper deposits, the Serpentine Copper-Nickel project could be a highly accretive cornerstone for Green Bridge.”

References:

The Historical Estimate states that it was prepared pursuant to NI 43-101 and in conformity with generally accepted ”CIM Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines. Mineral Resources have been classified in accordance with the “CIM Standards on Mineral Resources and Reserves: Definition and Guidelines”. The historical Technical Report was done by a professional and well-respected agent in 2020, and the Company feels that the historical estimates produced by the author of that report are reliable and relevant to the deposit. The Company plans to conduct independent sampling of historically drilled core, as well as a site visit to verify drill hole location in order to independently verify results published in the historic Technical Report. At this time, the Company has had an independent group review the resource model and verify the validity of the results published in the historical Technical Report, giving the Company confidence in the historical resource values stated here. The Company will produce a new NI 43-101 Technical Report, which will include an independently prepared resource estimate that accurately reflects current market conditions.

A qualified person has not done sufficient work to classify the Historical Estimate as current mineral resources, and the Company is not treating the Historical Estimate as current mineral resources.

With respect to adjacent and regional projects, the Company clarifies that such disclosures relate solely to adjacent and regional projects in which the Company does not hold an interest, and that there can be no assurance that the Company will obtain similar information from its own projects regardless of proximity, nor is the Company implying that it will obtain similar results on its own projects.

All scientific and technical information, and written disclosure in this news release has been prepared or approved by Ajeet Milliard, Ph.D., CPG, Chief Geologist for Green Bridge Metals and a qualified person (QP) for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Green Bridge Metals

Green Bridge Metals Corporation is a Canadian based exploration company focused on acquiring ‘critical mineral’ rich assets and the development of the South Contact Zone (the “Property”) along the basal contact of the Duluth Complex, north of Duluth, Minnesota. The South Contact Zone contains bulk-tonnage copper-nickel and titanium-vanadium in ilmenite hosted in ultramafic to oxide ultramafic intrusions. The Property has exploration targets for bulk-tonnage Ni mineralization, high grade Ni-Cu-PGE magmatic sulfide mineralization and titanium.

ON BEHALF OF GREEN BRIDGE METALS,

“David Suda”

President and Chief Executive Officer

For more information, please contact:

David Suda

President and Chief Executive Officer

Tel: 604.928-3101

investors@greenbridgemetals.com

In Europe

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

Forward Looking Information

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to: the negotiation and completion of a definitive agreement and closing of the option to acquire the Serpentine Project; exploration and development of the Serpentine Project, and the potential for further exploration or development of the Project.

Although management of the Company believe that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These risk factors include, but are not limited to: a definitive agreement and closing of the option to acquire the Serpentine Project may not occur as currently contemplated, or at all; the exploration and development of the Serpentine Project may not result in any commercially successful outcome for the Company; risks associated with the business of the Company; business and economic conditions in the mining industry generally; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time.

The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Table 1. Historical Pit-Constrained Mineral Resource Estimate as provided by Puritch et al (2020)

1. Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate

of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical,

marketing, or other relevant issues.

2. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated

Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the

majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with

continued exploration.

3. The Mineral Resources in this Technical Report were estimated in accordance with the Canadian Institute of

Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions

and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM

Council.

4. No Mineral Resources are classified as Measured.

5. Totals may not sum due to rounding.

6. Cut-off = NSR $8.50/t; Cu-Equivalent (Cu-Eq)% =NSR/49.92.

7. Cu = copper, CuEq = copper equivalent, Ni = nickel, Co = cobalt, S = sulphur, NSR = net smelter return.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()