Gold and platinum

Breaking News:

International anerkannter Gesundheitsexperte Dr. Peter Singer ab sofort Scientific Advisor

Tierschutzhunde verstehen: 7 Mythen, die du kennen solltest – und wie echte Bindung entsteht

Digitale Archivierung leicht gemacht – So profitieren Unternehmen von E-DVD-Dienstleistungen

Wassergekühlte Diamantbohrer: Die optimale Lösung für präzises Bohren

Samstag, Dez. 20, 2025

On the global political stage, the easing of tensions in a number of conflict hotspots has caused the price of gold to fall. China and the USA, India and Pakistan or the meeting between Russia and Ukraine. The gold price is therefore currently in a consolidation phase. Some investors are sure to strike and invest. The reasons for a high gold price continue to exist and could even increase. The beneficiaries are, of course, the companies that own gold in their mining projects. This is because profit margins have increased significantly. Nevertheless, many companies are valued as if the gold price were only half as high as it actually is. At the same time, the costs of extracting this valuable commodity from the ground have hardly changed. Significant price gains could therefore be on the horizon. Some are already saying that "the mining sector has entered a new golden era". And many share prices have not yet followed this development, which creates opportunities for investors.

But platinum should also be given the attention it deserves. After the platinum price suffered badly in March, it is now in a sideways phase at a high level. Platinum is known as an excellent catalyst, particularly in the automotive industry. There it reduces emissions. Experts expect demand for platinum to rise as the metal is increasingly being used in the automotive industry. It is also used in fuel cells. The precious metal is also rarer than gold and silver. The largest producer of platinum is South Africa. Around 70 percent of platinum comes from there.

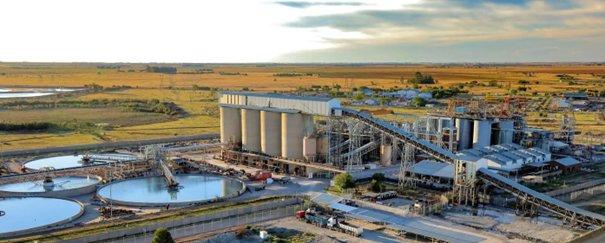

Sibanye-Stillwater – https://www.commodity-tv.com/ondemand/companies/profil/sibanye-stillwater-ltd/ – produces platinum, palladium and gold there and in the USA. The company also has battery metals on its radar.

In Suriname, the smallest independent country in South America, Miata Metals – https://www.commodity-tv.com/ondemand/companies/profil/miata-metals-corp/ – is concentrating on two promising gold projects.

Current company information and press releases from Miata Metals (- https://www.resource-capital.ch/en/companies/miata-metals-corp/ -) and Sibanye-Stillwater (- https://www.resource-capital.ch/en/companies/sibanye-stillwater-ltd/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()