When could the price of uranium rise again?

Breaking News:

Montag, Feb. 16, 2026

Most analysts agree that demand for uranium will grow significantly. Global demand is even expected to double by 2040. This is because energy policy is being realigned. Electricity demand is growing, partly due to the rapid construction of data centers. There are currently not many new uranium projects close to production. This makes emerging companies with good uranium projects all the more important for the future of the nuclear industry, even if it takes years for new mines to be approved and go into production. There are also geopolitical uncertainties in the uranium market, causing energy suppliers to hesitate to sign long-term uranium contracts.

Last year, contracts for long-term deliveries of only 48 million pounds were signed, even though the replacement rate is around 150 million pounds of uranium. And in order for more uranium to be produced, some producers, such as Kazatomprom, argue that higher uranium prices are necessary first. Caution seems to be the order of the day in the uranium market. However, the demand for uranium is there, and so the market is structurally undersupplied. Due to the three well-known major reactor accidents, nuclear energy has long been socially unacceptable, and investments have therefore become rare.

Today, it is clear that without nuclear power, the world’s growing appetite for energy cannot be satisfied, at least not for a long time to come. Renewable energies such as wind, solar, and hydro power are simply not enough. In times without wind or sun, the hunger for energy does not take a break. And for digitalization and artificial intelligence, a continuous and reliable power supply is essential. Added to this is the desired move away from fossil fuels. Investing in uranium and uranium companies could therefore be worthwhile for investors.

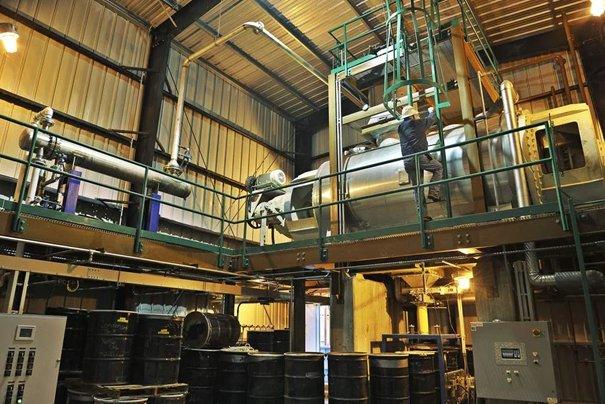

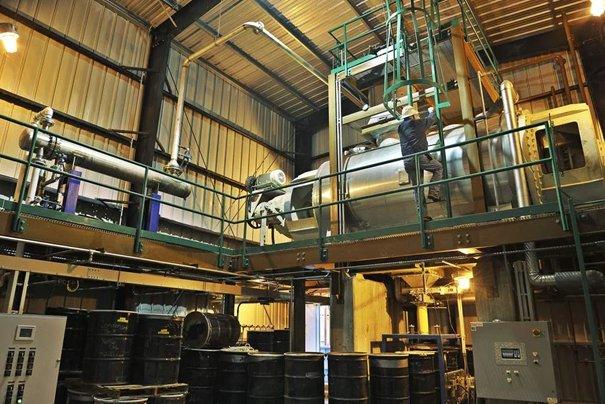

Uranium Energy – https://www.commodity-tv.com/ondemand/companies/profil/uranium-energy-corp/ – has diversified uranium holdings and ISR uranium projects in the US, with additional projects in Canada. Uranium mining, processing, refining, and conversion are part of the business. The company is debt-free and is now the only US supplier that can deliver uranium and uranium hexafluoride (used in uranium enrichment).

IsoEnergy – https://www.commodity-tv.com/ondemand/companies/profil/isoenergy-ltd/ – is considered a uranium producer that could go into production in the near future and has high-grade uranium properties in Saskatchewan. Other uranium projects are located in Australia, Argentina, and the US. The Larocque East project in the Athabasca Basin in Saskatchewan is particularly high-grade. There is also fresh cash in the coffers.

Current company information and press releases from IsoEnergy (- https://www.resource-capital.ch/en/companies/iso-energy-ltd/ -) and Uranium Energy (- https://www.resource-capital.ch/en/companies/uranium-energy-corp/ -).

Further information is also available in our new uranium report at the following link: https://www.resource-capital.ch/en/reports/view/uran-report-2022-11-update/

Sources:

https://www.miningscout.de/blog/2025/12/19/uran-sprott-sieht-potenzial-fuer-aufholjagd-2026/;

https://www.resource-capital.ch/en/reports/view/uran-report-2022-11-update/

In accordance with Section 85 of the German Securities Trading Act (WpHG) in conjunction with Article 20 of Regulation (EU) 2016/958 (MAR), we hereby disclose that authors/employees/affiliated companies of SRC swiss resource capital AG may hold positions (long/short) in issuers discussed. Remuneration/relationship: IR contracts/advertorial: Own positions (author): none; SRC net position: less than 0.5%; issuer’s stake in SRC ≥ 5%: no. Update policy: no obligation to update. No guarantee for the translation into German. Only the English version of this news release is authoritative.

Disclaimer: The information provided does not constitute any form of recommendation or advice. We expressly draw attention to the risks involved in securities trading. No liability can be accepted for any damage arising from the use of this blog. We would like to point out that shares and, in particular, warrant investments are generally associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the accuracy of all content. Despite the utmost care, I expressly reserve the right to errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but does not claim to be accurate or complete. Due to court rulings, the content of linked external sites is also our responsibility (e.g., Hamburg Regional Court, in its ruling of May 12, 1998 – 312 O 85/98), as long as we do not expressly distance ourselves from them. Despite careful content control, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of SRC swiss resource capital AG, which is available at https://www.resource-capital.ch/de/disclaimer-agb/, applies additionally.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()